santa clara property tax appeal

This conversation came at a time that my own property tax assessments from Santa Clara County have just arrived in the mail reminding me that I need to reconsider the comparable sales in my area and decide whether it is time to contact the Assessors Office with the information. The clerks of county assessment appeals boards and county boards of equalization have certified the assessment appeals filing period for their counties pursuant to the requirements of Revenue and Taxation Code section 1603.

Please note the review process may take 45-90 days.

. 1555 CASTILLEJA Submit-OR-Enter Property Parcel. If you have any questions please call 408-808-7900. If you have questions or need assistance please call 408 808-7900 from 900 AM to 400 PM on Monday-Friday or email at DTAC-CancelPenaltyfin.

As a property owner you have the right to appeal the property tax amount you are charged and request a reassessment if you believe that the value determined by the Santa Clara County Tax Assessors office is incorrect. A Santa Clara County tax assessor filed a lawsuit in Superior Court on Monday in an attempt to reverse a decision that awarded a 36 million property tax refund to the 49ers. Enter Property Address this is not your billing address.

PROPERTY ASSESSMENT INFORMATION SYSTEM. Attach documentation that supports the basis of your request to cancel your tax penalty. Appeal of Administrative of Architectural Committee or Planning Commission Decisions Form PDF Last Updated.

Send us an Email. Notices such as these are not authorized nor sent by the County of Santa Clara Department of Tax and Collections. REDUCE PROPERTY TAXES.

Please be advised any notices sent by the Department of Tax and Collections will have the County Seal and the Department of Tax and Collections contact information. When you get that yellow notice in the mail do not ignore it. Looking for the best property tax reduction consultant in Santa Clara California to help you with property tax appeal.

The regular appeals filing period will begin on July 2 2021 in each county and will end. Appeal of Supplemental or Escape Assessment within 60 days from the date of the assessment. To appeal the Santa Clara County property tax you must contact the Santa Clara County Tax Assessors Office.

February 2020 Residential Property Assessment Appeals 1. Scheduled Downtimes Secured Property Search. Appeal of Regular Assessment during the Regular Filing Period July 2 September 15.

Appeal applications must be filed between July 2 to September 15 with the Clerk of the Board. We are a national consulting firm that has the necessary experience to serve clients all over the country by providing them with property tax help that is both effective and efficient. The County of Santa Clara CA.

Acknowledging the unfairness of a taxpayer winning a property tax assessment appeal but not receiving a refund of the fee required to file the appeal Supervisor Simitian led the Board in eliminating the fee for filing an appeal altogether. COUNTY ASSESSMENT APPEALS FILING PERIODS FOR 2021. Monday May 2 2022 743 AM PST.

Browse HouseCashins directory of Santa Clara top tax advisors and easily inquire online about their property tax protest consulting services. Our local expertise makes it possible. Currently you may research and print assessment information for individual parcels free of charge.

Introduction The property taxes you pay are based on your propertys assessed value as determined by your County Assessor. Each three member Assessment Appeals Board which is independent of the Assessor and trained by the State Board of Equalization consists of private sector property tax professionals CPAs Attorneys and appraisers appointed by the Santa Clara County Board of Supervisors. The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number APN for real property in Santa Clara County.

If you disagree with the Assessors value you can usually appeal that value to your local assessment appeals board or county board of equalization. Sign and date the form and submit online or by mail. A secured property tax bill is generally a tax bill for real property which could include your home vacant land commercial property and the like.

Paradigm Tax Group is here to supply our clients in Santa Clara County and San Mateo County with property tax assistance. Santa Clara County repeals fee for property assessments. If the last day of the filing period falls on a weekend or holiday an application filed on the next business day shall be deemed timely filed.

The tax is a lien that is secured by the landstructure even though no document was. Department of Tax and Collections. The term secured simply means taxes that are assessed against real property eg land or structures.

Enter Property Parcel Number APN.

Frequently Asked Questions Office Of Veterans Services County Of Santa Clara

2261 Bowers Ave Santa Clara Ca 95051 Mls Ml81848455 Redfin

Career Summer Institute Csi Behavioral Health Services County Of Santa Clara

San Jose Council Review Budget Proposals Development Appeal San Jose Spotlight

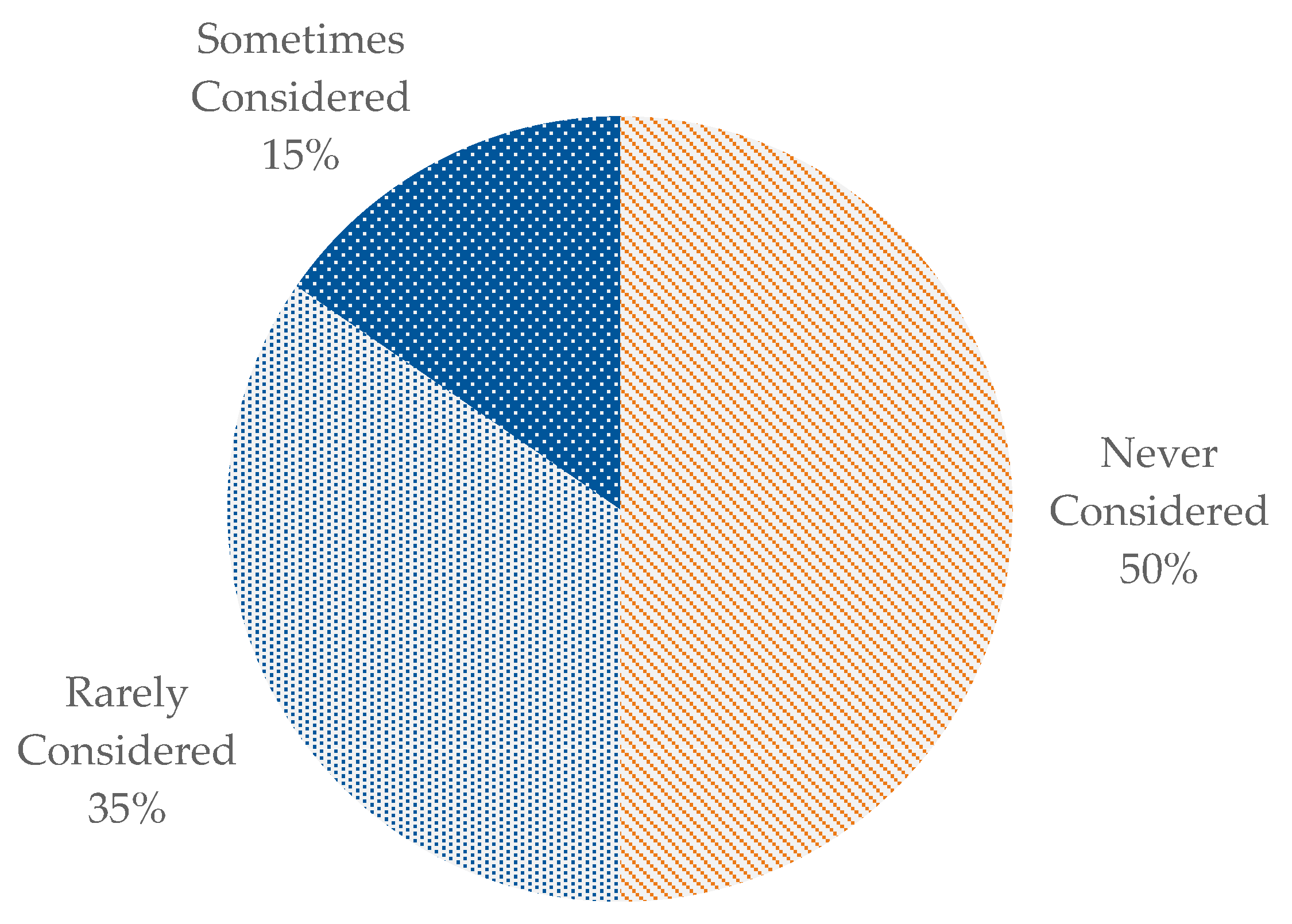

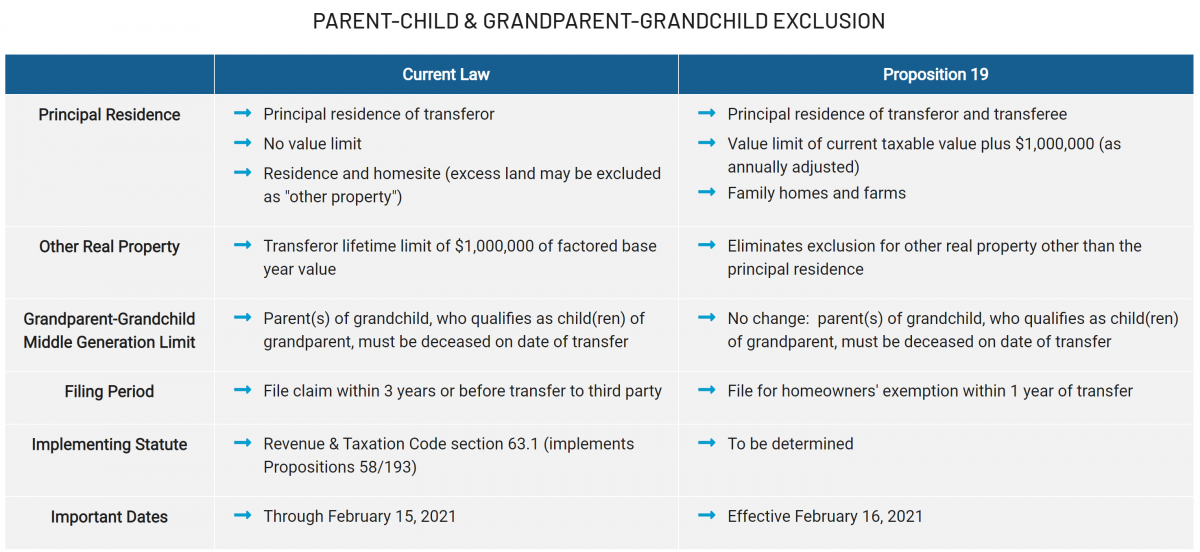

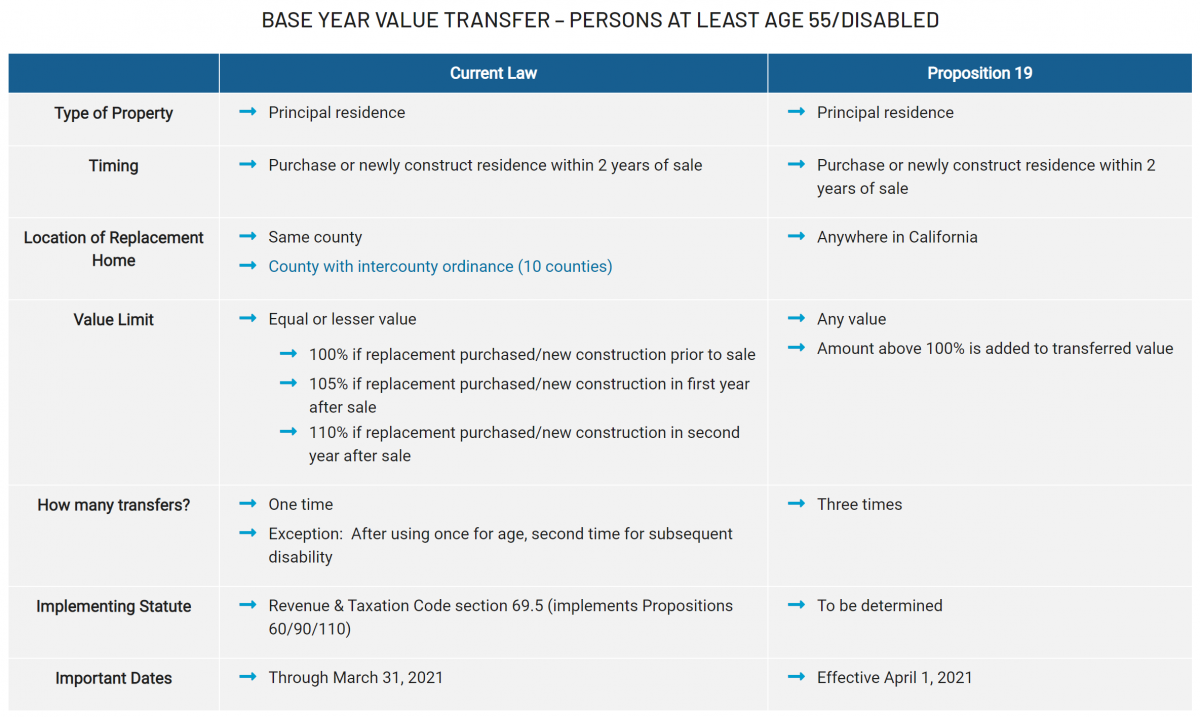

About Proposition 19 2020 Ccsf Office Of Assessor Recorder

1885 Harrison St Santa Clara Ca 95050 Mls Ml81874787 Redfin

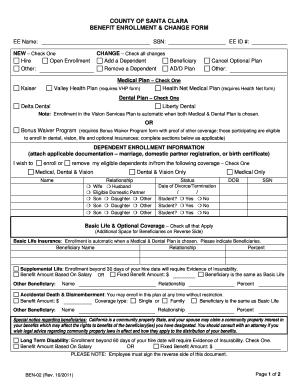

Fillable Online Sccgov County Of Santa Clara Benefit Enrollment Change Form Sccgov Fax Email Print Pdffiller

About Proposition 19 2020 Ccsf Office Of Assessor Recorder

Behavioral Health Services Call Center Behavioral Health Services County Of Santa Clara

Sustainability Free Full Text Planning Perspectives On Rural Connected Autonomous And Electric Vehicle Implementation Html

California Public Records Public Records California Public

2952 Fresno St Santa Clara Ca 95051 Mls Ml81872640 Redfin

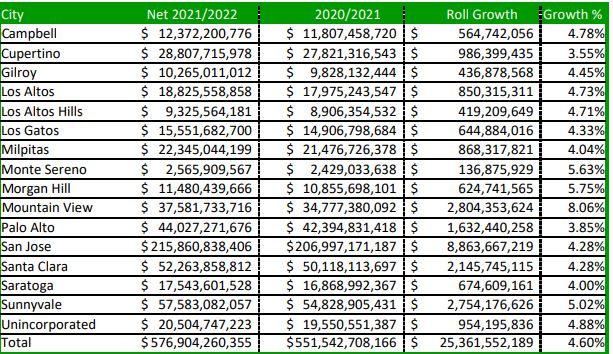

Roll Close Media Release 2021 Assessment Roll Growth Slows To 25 4 Billion But Escapes Worst Covid Projections

Public Works Gis Day Expo Page Information Technology Division

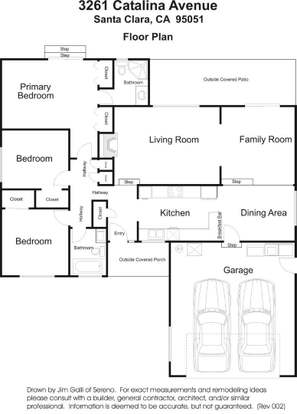

3261 Catalina Ave Santa Clara Ca 95051 Mls Ml81864643 Redfin

Santa Clara County Advocates Celebrate Win For Immigrants News Mountain View Online