unemployment income tax refund status

If youre looking for your federal refund instead the IRS can help you. Web We filed for unemployment benefits for those furlough weeks.

Will You Get A Second Income Tax Refund Irs Starts Issuing Unemployment Refunds

Web Box 1 Enter the unemployment compensation shown in Box 1 of federal Form 1099-G.

. Web To track your state refund select the link for your state from the list below. Web California State Income Tax Refund. Tax year of the refund.

Web If you received unemployment compensation but didnt get Form 1099-G in the mail find the amount of your payments on your state unemployment agency. To check the status of your personal income tax refund youll need the following information. Your Social Security number or Individual Taxpayer.

Web The IRS has sent 87 million unemployment compensation refunds so far. However if as a result of the excluded unemployment compensation taxpayers are. Web Unemployment tax refund status.

The 10200 is the amount of income exclusion for single. Using the IRS Wheres My Refund tool. Web Income Tax Refund Information.

Web Most taxpayers need not take any action and there is no need to call the IRS. Check the status of your refund through an online tax account. You can check the status of your current year refund online or by calling the automated line at 410 260-7701 or 1-800-218-8160.

The FTB withheld all or part of your California state income tax refund to repay your UI or SDI overpayment debt. On March 11 2021 Congress passed the American Rescue Plan Act which among other things. The exact refund amount will depend on the persons overall income jobless benefit income and.

New York State tax withheld Enter the New York State income tax withheld as shown. Web The unemployment tax refund is only for those filing individually. After more than three months since the IRS last sent adjustments on 2020 tax returns.

Web To check the status of your 2020 income tax refund using the IRS tracker tools youll need to give some information. Web Whether you owe taxes or youre expecting a refund you can find out your tax returns status by.

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

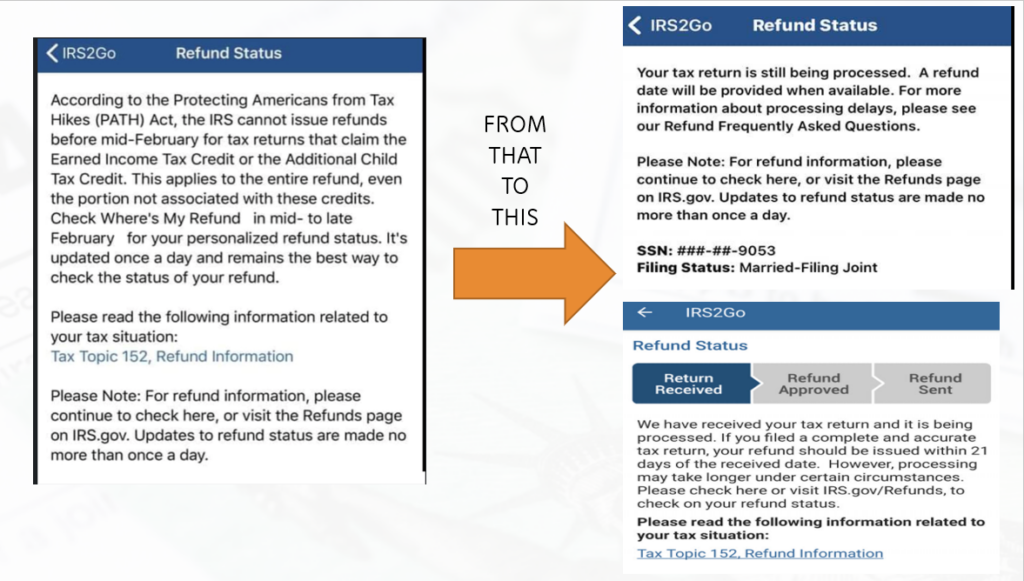

Refund Status Your Tax Return Is Still Being Processed And Refund Date To Be Provided Why And How Returns With Errors Are Being Handled By The Irs Aving To Invest

Unemployment Tax Refund Update What Is Irs Treas 310 Weareiowa Com

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment The Us Sun

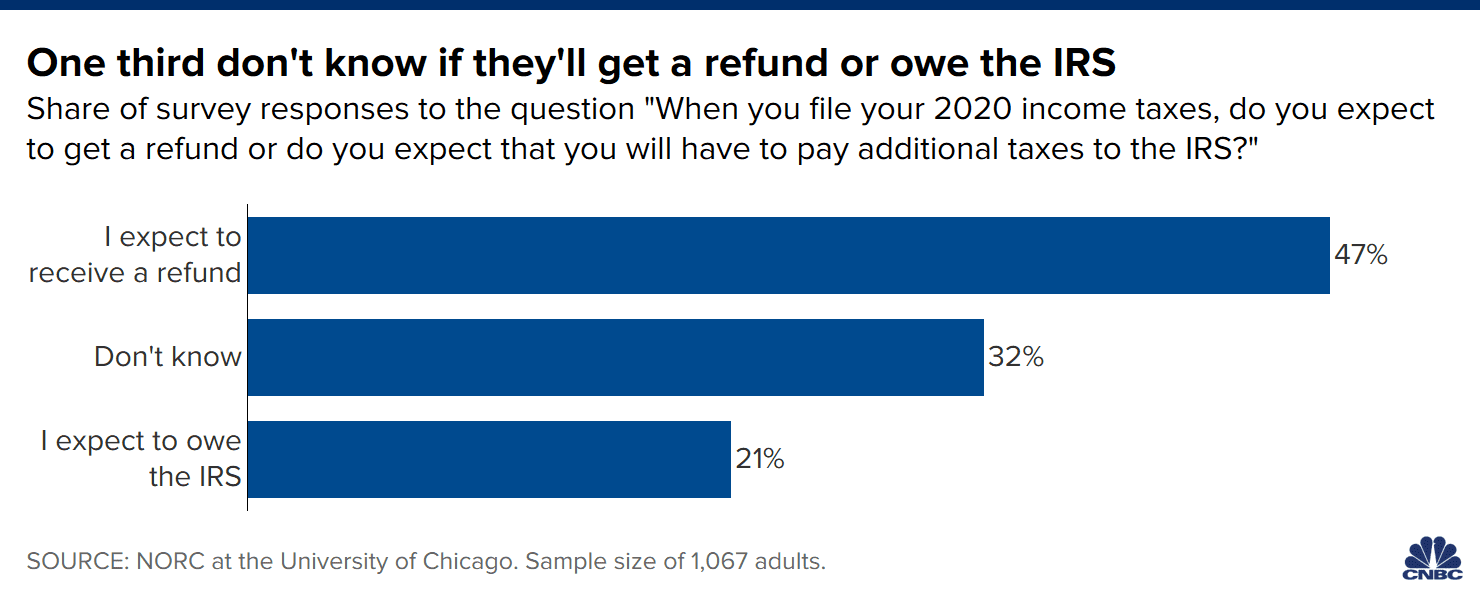

Will You Get A Tax Refund Or Owe The Irs 32 Of Americans Don T Know

What To Know About Irs Unemployment Refunds

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Unemployment Tax Refund 169 Million Dollars Sent This Week

How To Get A Refund For Taxes On Unemployment Benefits Solid State

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News

Jobless Workers May Face A Surprise Tax Bill Or Smaller Refund

Is Unemployment Taxed H R Block

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

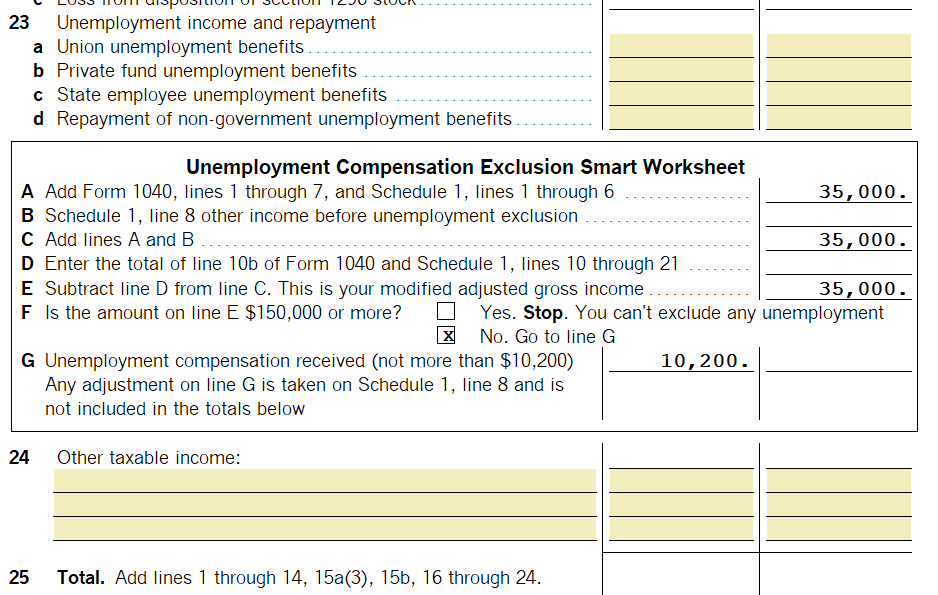

Generating The Unemployment Compensation Exclusion In Proseries

Exclusion Of Up To 10 200 Of Unemployment Compensation For Tax Year 2020 Only Internal Revenue Service

Irs Tax Refund Calendar 2023 When To Expect My Tax Refund

Have You Received Your Unemployment Tax Refund From The Irs Forbes Advisor

Here S When You May See A Tax Refund On Unemployment Benefits Up To 10 200 Pennlive Com